Generating stable mid-long term profits from the forex market require high level of trading experiences. The estimated turnover per day in the Forex industry is valued at over US$4 trillion. The trading program offers attractive managed fund services tapping into this huge market using proven trading strategy which is the combination of superior trading systems and highly experienced fund managers . Our trading program offers a unique opportunity to investors that understand the potential of the foreign exchange markets and expecting steady and exponential returns on their investment . The nature of the Forex market allows for extraordinary high returns because of the sheer volume traded daily. The trading program provides our clients with the opportunity to take part in the forex cycle through our managed fund services.

Features and Advantages

Funds managed by professional fund managers using sophisticated trading strategies.

Multiple choices of account funding, bank wire, debit/ credit card, PayPal.

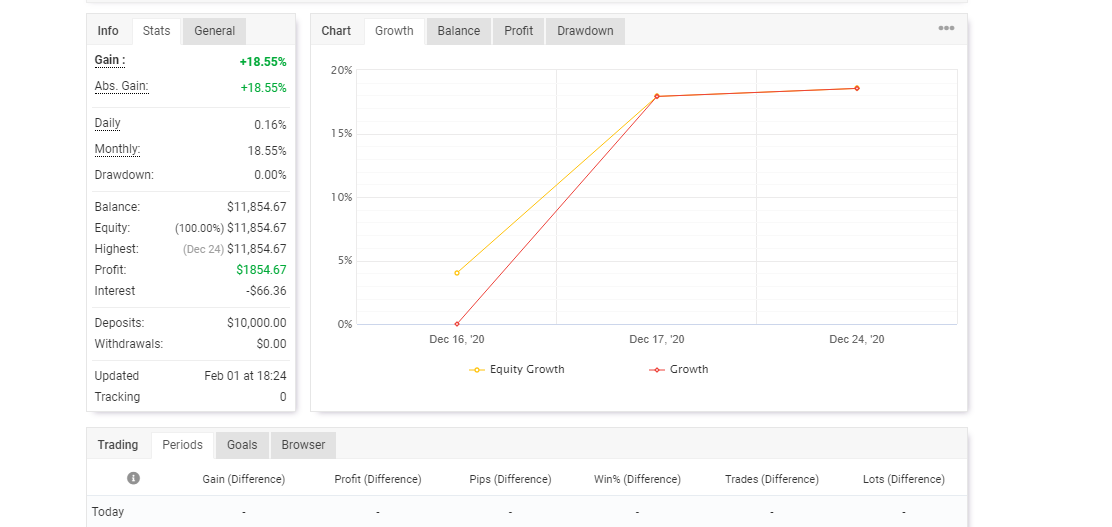

Real-time account access via MetaTrader 4 platform investor password – to view overall group performance.

Real-time web based account access – to view individual report viewer.

Real-time account access to FX Stat forex analytics – to view overall group performance.

Multiple PAMM/MAM accounts allowed.

PAMM/MAM account Pit Stop/ interval approximately 120-270 days, depending on market conditions.

Easy funds redemption/ withdrawals, transfer from group to personal MT4 processed within 1-2 business days.

Service fee – 30% performance fee.

Best Execution

Access to deep liquidity from top tier banks and ECNs

Best bid and ask prices available in the market

Fast and Accurate Trade executions

Competitive Spreads

Safety of Funds

Segregation of funds

All clients funds are segregated under the respected regulator’s client funds rules and cannot be used by the brokers and receive priority in the event of bankruptcy.

Funds in Tier 1 Bank Accounts

Clients funds and brokers funds are both kept in top tier banks like JP Morgan Chase Bank, HSBC Bank, Citi Bank, Barclays Bank and few others from different jurisdictions.

Protection through the Financial Services Compensation Scheme (FSCS)

Clients may be eligible to put a claim into the Financial Services Compensation Scheme (FSCS) in the event the brokers are unable to meet its financial obligations. Eligibility depends on the status and the nature of the claim.