Targeted IRR: 20%

Asset Class: mixed

Investment Period: 3 months

Unit Investment: $1,200

Fund Size: $2,500,000

Registration Type: 506(c)

HSDP FUNDS Inc is a fund management firm dedicated to providing turn-key, cash-flow focused investments in the online business and trading space, where investors can invest with confidence.

HSDP FUNDS Inc accomplishes this through maintaining key focus on net profits and abiding by its core investment values associated with minimizing risk and maximizing returns. Our expertise is in providing cash-flow focused, risk adjusted assets in a streamlined platform where investors can gain never before seen accessibility, transparency, and an ease of involvement.

HSDP FUNDS Inc employs a highly disciplined investment strategy focused on the deployment of high level trade strategies uncommon in the business and trading world.

HSDP FUNDS Inc has been in business for 6 years with over 100+ investment transactions under their belt.

HSDP FUNDS Inc is proud to note that since inception, no investor has ever lost money. As a firm, HSDP FUNDS Inc provides their investment partners with investment structures from Equity to Debt positions, in the form of both Direct Investments and Fund structures.

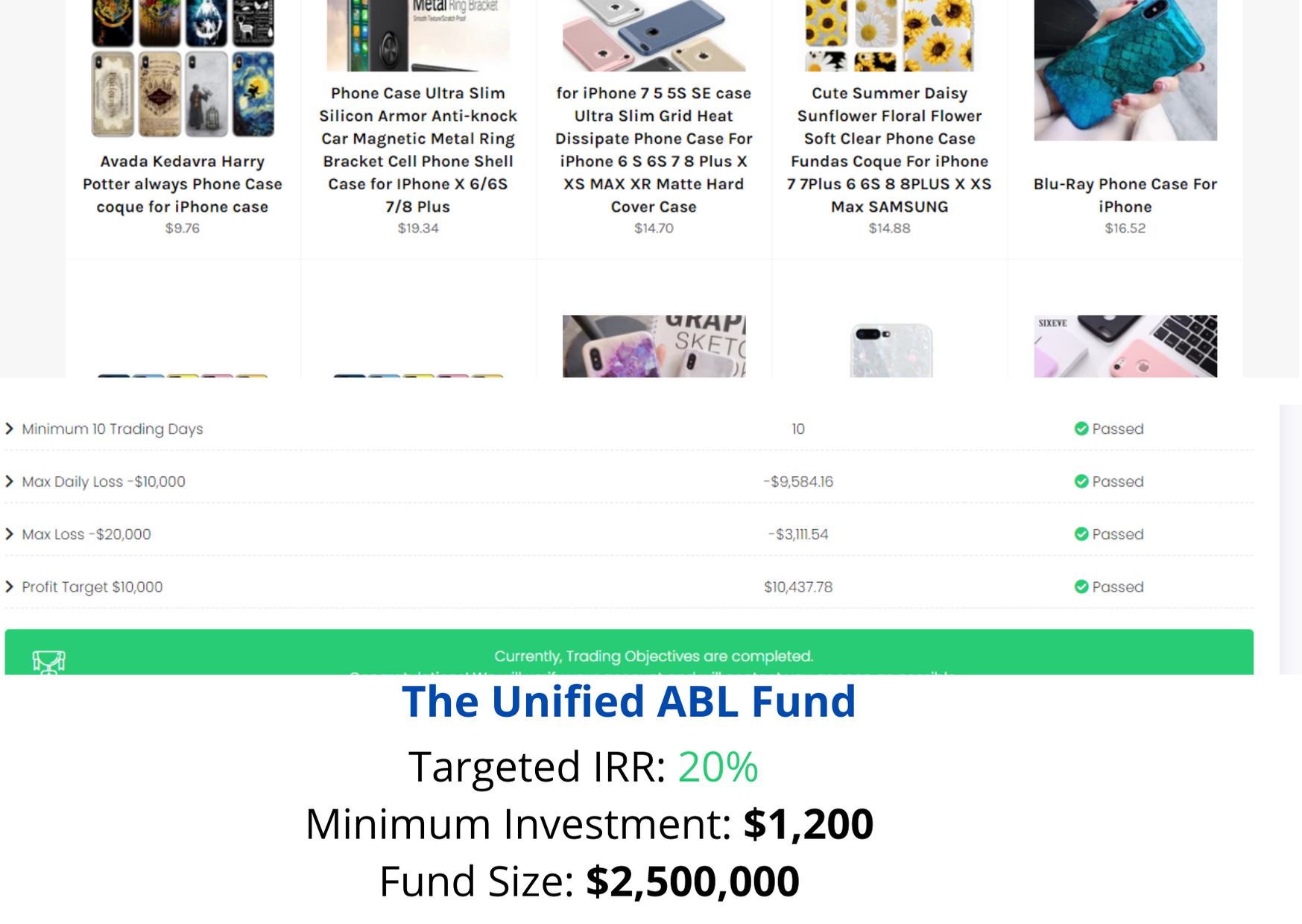

THE UNIFIED ABL FUND

The Unified ABL Fund (“The Fund”) is focused on providing secure, above-average investment returns through Financing the strategic operations and asset management of mixed class of online assets demonstrating strong net profit margins, cash-flow, stability, and growth potential.

The Fund has been designed to allow investors to be involved in a diversified portfolio of alternative investments where their principal investment can be fully collateralized by The Fund’s assets. The Fund works to provide investors an attractive rate of return, so that investors can have an income producing investment that pays on a set schedule.

Upon investment, investors become a member of this fund and will receive an 20% interest rate of return. Return on investment begins immediately.

KEY DEAL POINTS

Diversification: With a single contribution, invest in diversified offerings across multiple proprietary firm funded forex accounts, private forex accounts, as well as several online business assets.

Value: Invest in a diversified portfolio offerings for only a $1,200 minimum investment amount, which would typically be a small fraction of what would be required to invest in any other similar offering.

Passive Investing Methodology: The Fund also allows investors to utilize the Passive Investing Method by having a Fixed Rate of Return paid out on a set schedule

Access: By investing via the HSDP FUNDS Investor Portal, investors receive priority access to the most sought-after investment offerings in the Marketplace.

20% Current Dividend Yield: The Fund pays a monthly distribution equal to an 20% rate on the investor’s principal investment.

Capital Protection: Every investment is fully collateralized by the Fund and its assets .

INVESTMENT OPPORTUNITY

Fund Type: Equity Fund

Fund Investments: Forex equity, online businesses, e-commerce

Investment Term: 3 months with option to renew

Distributions: Monthly Rate

Rate Return: 20%

Management Fee: None

Unit Investment: $1,200

Target Fund Size: $2,500,000

BUSINESS PLAN

The Unified ABL Fund (“The Fund”) is a $2,500,000 fund that is diversified amongst several HSDP FUNDS Inc assets in the United States, Europe and online. The Fund provides equity financing at a Fixed Rate of 20% interest to cash-flowing assets in the Market with a focus in Forex equity, online businesses, e-commerce.

The Unified ABL Fund was formed to capitalize on HSDP FUNDS Inc’s steady pipeline of exciting investment opportunities.

HSDP FUNDS Inc. is offering units in The Unified ABL Fund for all investors, and every investor is fully collateralized by the assets and cash-flow of The Fund.

The HSDP FUNDS Strategy

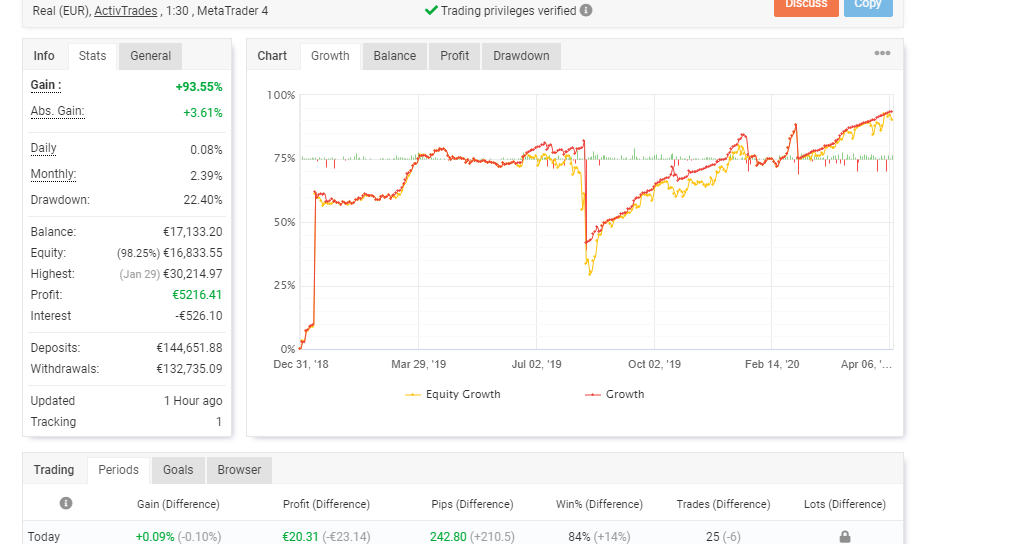

The vision of HSDP FUNDS’ leadership is to deliver qualified returns on investments by hedging risk, execute various trading strategies in equities, futures, Forex, options and commodities, providing two-sided liquidity on over 50 market centers around the world.

Two main lines of strategies developed namely Commodity Futures Market Making and Ticker Tape trading which analyses a multitude of market trends, observing a flow of quotes, with capability of extracting information that has not yet crossed the news screens, and then makes trades on them faster than any human possibly could.

Implemented several more strategies to exploit other types of arbitrage opportunities, including Volatility Arbitrage, Statistical Arbitrage, combined with Continuous Price Prediction.

Has a potential sharp ratio (a measure of risk and reward) thousands of times higher than traditional buy-and-hold strategies.

Maintains positions for relatively short intervals and all positions are closed by the end of each trading day with no overnight risk.

Our investment approach is driven by a combination of fundamental research, advanced market analysis, revolutionary technology platform and a persistent drive to excel on behalf our investors. We are proud to be in the market to offer high frequency trading access to private trading pools. Often, retail clients do not have the access to this high profile trading pool simply because of the high entry requirements, limited offers and availability only to institutions.

INVESTMENT OVERVIEW

Risk Mitigation

The Unified ABL Fund focuses on strict lending principles to maintain the strongest likelihood of success. The Fund itself lends to assets with:

Strong Financials

High Cash-Flow Pro Forma

Strong economical markets

Diversification of Assets

A proven track record

HSDP FUNDS Inc as a firm has been in business for over 6 years, has executed over 100+ transactions, and no investor has ever lost money with them.

Past performance does not, however, guarantee future results.

Targeted Expansion

We will focus on growing equity in proprietary trading and private equity, increased customer acquisition, more robust marketing campaigns, and improvement in staff quality, number and efficiency.